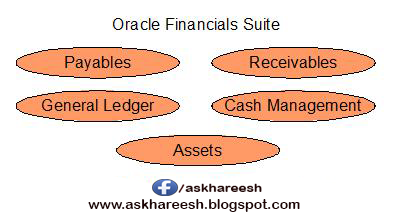

Assets

- Complete All Transactions for the Period Being Closed

- Assign All Assets to Distribution Lines

- Run Calculate Gains and Losses (Optional)

- Run Depreciation

- Create Journal Entries

- Rollback Depreciation and/or Rollback Journal Entries (Optional)

- Create Deferred Depreciation Journal Entries (Optional)

- Depreciation Projections(Optional)

- Review and Post Journal Entries

- Reconcile Oracle Assets to Oracle General Ledger Using Reports.

- Run Responsibility Reports (Optional)

- Archive and Purge Transactions (Optional)

Projects

- Change the Current Oracle Projects Period Status from Open to Pending Close

- Open the Next Oracle Projects Period

- Complete All Maintenance Activities

- Run Maintenance Processes

- Complete All Transaction Entry for the Period Being Closed

- Run the Final Cost Distribution Processes

- Interface Transactions to Other Applications (AP, GL, FA)

- Generate Draft Revenue for All Projects

- Generate Invoices

- Run Final Project Costing and Revenue Management Reports

- Transfer Invoices to Oracle Receivables

- Interface Revenue to General ledger (Project Billing Only)

- Run Period Close Exception and Tieback Reports

- Change the Current Period Oracle Projects Status from Pending Close to Closed

- Advance the PA Reporting Period (Optional)

- Update Project Summary Amounts

- Restore Access to User Maintenance Activities

- Permanently Close the Oracle Projects Period (Optional)

- Reconcile Cost Distribution Lines with General Ledger (Optional)

Cash Management

- Load Bank Statements

- Reconcile Bank Statements

- Create Miscellaneous Transactions

- Review AutoReconciliation Execution Report

- Resolve Exceptions on the AutoReceonciliation Execution Report

- Run Bank Statement Detail Report

- Run Transactions Available for Reconcilaition Report

- Resolve Un-reconciled Statement Lines

- Run the GL Reconciliation Report

- Run the Account Analysis Report for the General Ledger Cash Account

- Review the Account Analysis Report

- Correct any Invalid Entries to the General Ledger Cash Account (Optional)

- Perform the Bank Reconciliation

General Ledger

- Ensure the Next Accounting Period Status is Set to Future Entry

- Complete Oracle Sub-ledger Interfaces to Oracle General Ledger

- Upload Journals from ADI (Applications Desktop Integrator) to Oracle General Ledger

- Complete Non-Oracle Sub-ledger Interfaces to Oracle General Ledger (Optional)

- Generate Reversal Journals (Optional)

- Generate Recurring Journals (Optional)

- Generate Mass Allocation Journals (Optional)

- Review and Verify Journal Details of Unposted Journal Entries

- Post All Journal Batches

- Run General Ledger Trial Balances and Preliminary Financial Statement Generator Reports (FSGs)

- Revalue Balances (Optional)

- Translate Balances (Optional)

- Consolidate Sets of Books (Optional)

- Review and Correct Balances (Perform Reconciliations)

- Enter Adjustments and / or Accruals and Post

- Perform Final Adjustments

- Close the Current Oracle Gneral Ledger Period

- Open the Next Oracle General Ledger Period

- Run Financial Reports for the Closed Period

- Run Reports for Tax Reporting Purposes (Optional)

- Perform Encumbrance Year End Procedures (Optional)

Note: This list talks at various points about the 'Standard Reports'. If you can name the standard period closing reports in various modules, that can add value to this list